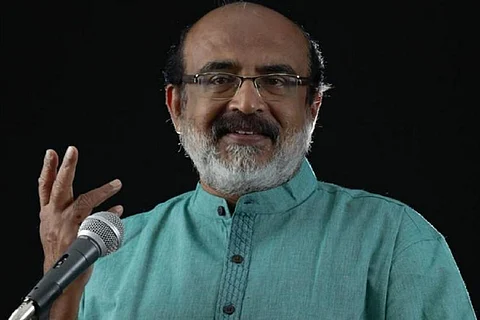

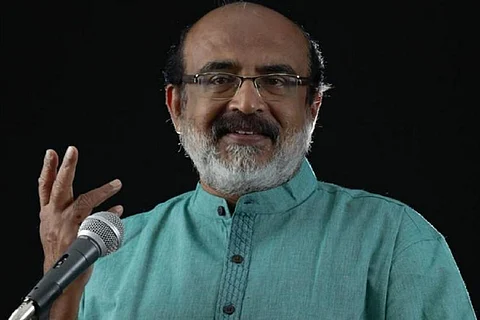

The Left government in Kerala is embroiled in a slew of controversies this year, which markedly started with the Kerala gold smuggling case. Even as some of the controversies are being investigated by multiple investigation agencies, the Pinarayi Vijayan government has found itself in another row, which was kicked off by the state Finance Minister, TM Thomas Isaac. At a press meet on November 14, the Minister flayed the Comptroller and Auditor General (CAG) report on the state’s finances, claiming that it called the Kerala Infrastructure Investment Fund Board’s (KIIFB) borrowing model unconstitutional. Minister Thomas Isaac is the Vice-Chairman of KIIFB, which is the state-owned financial institution for financing large and critical infrastructure projects in Kerala.

However, the Congress-led Opposition in Kerala moved a breach of privilege against Thomas Isaac for making public the content of the report when it was yet to be tabled in the Assembly. A CAG draft report is a private communication between the CAG and the government, which is not to be made public. What further fuelled the row was when the Finance Minister claimed that it was only a ‘draft’ of the 2018-19 audit report and it had called the KIIFB borrowing unconstitutional. He later corrected himself when the CAG issued a statement on Tuesday, clarifying that the report was final.

In the statement, dated November 11 (although it was made public on November 16), the CAG said that it had forwarded the audit report on state finances to the state government on November 06, 2020, for presentation in the Legislative Assembly. In accordance with Article 151 of the Constitution, the CAG is required to forward the 'Audit Report' on the Accounts of the state government to the Governor, who will direct it to be laid before the state Legislature.

However, what turned the issue into a political row was when Isaac pleaded ignorance by calling the report a “draft”. It's observed that it is surprising that a man of his stature could not identify the format of the report, since he has been the Finance Minister for around a decade in two separate terms. In the press meet on Tuesday, Isaac also said that it was not a minister’s job to check such details.

The CAG audits the expenditure of the Union and state governments and all state-funded institutions. The CAG audits the state finances on a regular basis and conducts the financial appropriation audit by the year-end. The final report, which includes their findings or analysis, is tabled in the state Legislative Assembly. The CAG also prepares the financial statement. In the normal course of things, the CAG asks the departments concerned for their response on the draft report, though it is not mandatory, especially in state financial audits.

Thomas Isaac questioned the CAG on the grounds that the freedom of financial institutions such as KIFFB cannot be surrendered. However, under Section 14 (1) of the CAG’s (Duties, Powers and Conditions of Service) Act, 1971, KIIFB, too, is liable to be audited by the constitutional authority. CAG can, thus, propriety audit KIIFB’s receipts and expenditure. This scope of this section, however, has some limitations.

The Act states that the CAG can take up a routine audit under Section 14(1), only if the government support or grant from the Consolidated Funds of India or state exchequer is “substantial”. By “substantial”, the Act means that (i) the grant should be more than Rs 25 lakh, and (ii) the annual grant should be 75% more than the annual expenditure. In KIIFB's case, the government grant is reportedly less than than the institution’s annual expenditure, especially since it had raised funds from overseas bonds by issuing masala bonds to foreign investors in March 2019.

In late 2019, the CAG wrote to the Kerala government, seeking authorisation to audit KIIFB under section 20(2) of CAG’s DPC Act. Section 20 (2) allows a statutory audit. Under this section, the CAG may seek authorisation to undertake auditing of accounts of any body or authority — the audit of which has not been entrusted to him by law — if he is of the opinion that such audit is necessary. It is up to the state government to grant the authorisation.

The state government, however, responded to the CAG, stating that the accounts of KIFFB need to be audited only as per section 14 (1) of DPC Act, adding that the demand for applying section 20 (2) is unwarranted. The Opposition criticised the state government’s refusal to allow CAG to conduct a comprehensive audit under section 20 (2). Opposition Leader Ramesh Chennithala demanded a comprehensive audit, stating that the state was receiving funds from non-government sources (masala bonds).

According to Isaac, the CAG, which audited KIIFB under section 14 (1), analysed the external borrowing of the state-owned entity and its implications on the state finances. He said that the report mentioned that the borrowing is against the constitutional provision and against 293 (1) of the constitution. He also added that the CAG had never made any such observation in its previous nine audits on KIFFB.

In March 2019, the KIIFB had raised Rs 2150 crore through the masala bonds. Masala bonds are issued by an Indian entity outside the country to raise funds from foreign investors. These bonds are issued in Indian currency and not foreign currency. KIIFB became the first state government agency to make a debut in the international debt market.

KIIFB was set up as a corporate entity by the Kerala government to raise funds for infrastructure projects in the state. As per the External Commerical Borrowings (ECB) guidelines by the Reserve Bank of India, all entities, which are eligible to receive foreign direct investment or FDI, can borrow overseas. Thus, the masala bonds of KIIFB is an external borrowing.

However, as per Article 293(1) of the Constitution, the executive power of a state extends to borrowing within the territory of India, while 293 (3) states that, states may not raise any loan without the consent of the Union government. Hence, through external borrowing via masala bonds, KIIFB violated the law, maybe the CAG's contention. This is the violation that the CAG has mentioned in its audit report, according to Thomas Isaac. He also said that body corporates under the union government, too, undertake external borrowing.

The Finance Minister, however, argued that raising overseas bonds is not unconstitutional as it is not done by the state but a corporate entity, which is KIIFB. But he also said that the KIIFB borrowing was budget borrowing (a loan taken by the government and falls under capital receipts in the budget document). This begs the question: if the borrowing isn’t done by the state, how can it be a budget borrowing.

Calling it a “one-sided” report, Thomas Isaac said that the CAG report is an attempt to hamper the state growth. He alleged that four chapters on KIIFB in the CAG report were added later from New Delhi, referring to the Union government. He reportedly accused the CAG of being a "hunter dog" of the Union government rather than being a "watchdog". He also alleged that it was the joint agenda of the BJP and the Congress to attack the state government on the matter. Terming it ‘unprecedented”, he said, “We have to be vigilant and Kerala should stand together against the moves to destroy KIIFB.”