Deloitte Haskins & Sells LLP resigned as the statutory auditor of Adani Ports & Special Economic Zone Ltd (APSEZ) on Saturday, August 12 citing “difference of opinion”. Deloitte alleged that the Adani Group did not consider getting an external inquiry done into the allegations made by US-based short-seller Hindenburg Research because of the ongoing investigation by the Securities and Exchange Board of India (SEBI). The auditing company further alleged that Adani was engaging in financial transactions with parties mentioned by Hindenburg but had told Deloitte that they were not related. Meanwhile, Adani has appointed MSKA & Associates as APSEZ’s auditor immediately after the resignation of Deloitte.

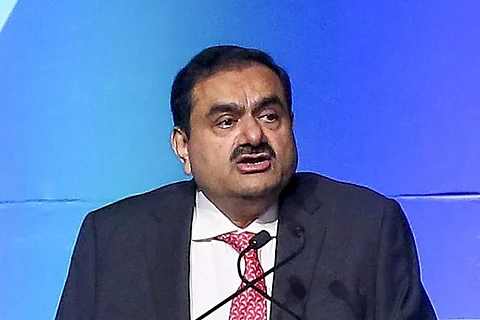

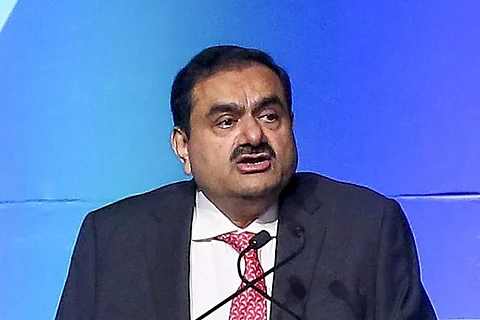

In January 2023, Hindenburg Research had said that Adani Groups “engaged in a stock manipulation and accounting fraud” and called it the “largest con in corporate history”. This stirred a massive reaction in India, both political and financial. Adani Group stocks fell and the group lost over $150 billion and subsequently, Gautam Adani was knocked off the list of the top 10 richest people in the world. The Supreme Court had directed SEBI to submit a report over the group’s market transactions by August 14, and Deloitte’s resignation comes just days before this.

In its notes to the financial statements, Deloitte stated that Adani Ports renegotiated the terms of sale of its container terminal which is under construction in Myanmar, which resulted in a loss of Rs 1,273.38 crore. According to news reports, in a recent meeting with the management of Adani Ports, Deloitte indicated that its role as auditor was not as wide as the other Adani companies.

Deloitte was first appointed as the auditor of Adani Ports in 2018 and was reappointed for another five years in 2022. This is the third change in auditors for the Adani Group in the last few months. Adani Ports is the biggest contributor of revenue in the Adani Group conglomerate headed by Gautam Adani.

In a statement, Adani Ports said that the reasons provided by Deloitte to resign as their auditor was not “convincing or sufficient to warrant such a move.” The statement also mentioned that the issues highlighted by Deloitte have been addressed in the 2023 financial statements and will be solved before the filing of financial statements in September 2023.