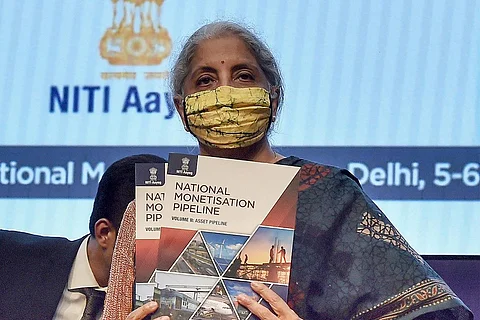

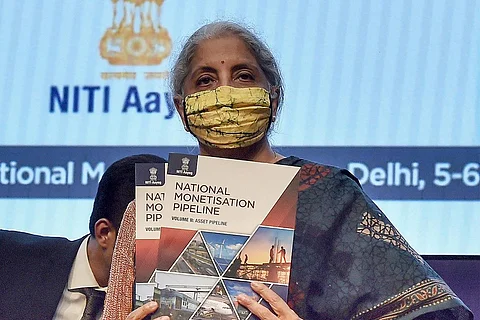

Finance Minister Nirmala Sitharaman unveiled a Rs 6 lakh crore National Monetisation Pipeline (NMP) earlier this week, which included involving private companies across infrastructure sectors — from passenger trains and railway stations to airports, roads and stadiums. "The asset monetisation pipeline takes the NIP (National Infrastructure Pipeline) to the next phase where you are looking at public-private partnership," she said. The pipeline has been developed by NITI Aayog based on what was announced during the Union Budget.

Is the government planning to sell assets?

The government isn’t selling these assets, and it isn’t looking to build anything new. Stating that there is no transfer of ownership or land, Finance Minister Nirmala Sitharaman had said, "The NMP talks about brownfield infra assets where investments have already been made, where there is a completed asset which is either languishing or which is remaining not fully monetised or which is remaining underutilised."

Brownfield assets are usually considered to be already developed assets but however may still require some expenditure. "The ownership of those assets remain with the government and there will be a mandatory hand-back after a certain time," she said.

How does this work?

Instead, in this case, private companies can invest for a fixed return using the infrastructure investment trusts (InvIT) route. An InvIT is similar to a mutual fund, where investors can pool in money for investing in infrastructure projects and they get returns on the investment. In this case, infrastructure assets are managed.

Otherwise, investors can operate and develop assets that the government has for a certain period, or take out something on lease for a long-term fixed period. This way, the government aims to make money on assets it already has, but is not optimally being used.

For example, some assets such as warehouses and stadiums can also be given on a long-term lease for operations.

"So by bringing in private participation into this, you are going to be able to monetise it better, and with whatever resources you obtain through the monetisation, you will be able to put in further investment into infrastructure," the Finance Minister said.

What is part of the pipeline?

Five sectors are ~83% of the aggregate pipeline value — Roads (27%) followed by Railways (25%), Power (15%), oil & gas pipelines (8%) and Telecom (6%).

> The biggest chunk of Rs 1.6 lakh crore is expected to come from monetising 26,700-km of existing operation national highways and new roads. NHAI will take the InvIT (Infrastructure Investment Trust) route for monetising some of these assets.

> Four hundred railway stations, 90 passenger trains, 741-km Konkan Railways and 15 railway stadiums and colonies are planned to be monetised for an estimated Rs 1.2 lakh crore.

> As many as 25 Airports Authority of India (AAI) airports, including ones at Chennai, Bhopal, Varanasi and Vadodara, as well as 40 railway stations, 15 railway stadiums and an unidentified number of railway colonies have been identified for getting private investments. The government estimates that airport monetisation will fetch Rs 20,782 crore and ports another Rs 12,828 crore.

> Monetising 28,608 circuit kilometres of power transmission lines is estimated to generate Rs 45,200 crore and another Rs 39,832 crore will come from 6 GW of power generation assets.

> The telecom sector will give Rs 35,100 crore from monetising 2.86 lakh km of BharatNet fiber and 14,917 signal towers of BSNL and MTNL.

> Close to Rs 29,000 crore each is estimated from monetising warehouses and coal mines.

> Monetising 8,154 kms of natural gas pipelines is estimated to give Rs 24,462 crore and 3,930-km product pipelines another Rs 22,504 crore.

> Monetising two national stadiums, including the Jawaharlal Nehru Stadium in New Delhi, and an equal number of regional centres (at Bengaluru and Zirakpur) is estimated to yield Rs 11,450 crore.

> Redevelopment of seven residential colonies in Delhi, including ones at Sarojini Nagar and Nauroji Nagaras well as development of residential/ commercial units on 240 acres of land in Ghitorni in Delhi has also been identified to garner Rs 15,000 crore.

When will this happen?

This pipeline of assets has been phased out over a four-year period starting FY 2022 up till FY 2025.

According to the Union government, a real-time monitoring monetisation dashboard will be available, through which this will be monitored.

What experts are saying

Meticulous planning, project packaging, and coordination will be needed to address the underlying structural and legacy issues, said Abhaya Agarwal, Partner, Infrastructure Practice, EY India.

"It would be important for the government to get the first few projects in each sector right to set the ball rolling in the right direction. Therefore, smooth implementation of the first Rs 10,000 crore will determine the fate of Rs 6 lakh crore monetization plan," Agarwal added.

Sanjay Dutt, MD & CEO, Tata Realty and Infrastructure Limited called it a step in the right direction.

“[It] will enable private players to enhance the operational capabilities of brownfield infrastructure assets. Moreover, it would provide an opportunity to upscale the development of the Indian infrastructure and is likely to positively higher FDI and the Domestic capital flow, lower the deficit, higher India rating and higher GDP for the economy,” he said.

“This move will boost privatisation and help the country to establish a stronger avenue for additional revenue that would help more public centric developments,” he added.

Political reactions

The Congress described the plan as "legalised loot and organised plunder", alleging that invaluable public assets created over decades are being handed over to a chosen few. The government is giving away assets worth crores made from the hard work of the people to its billionaire "friends", the Congress further alleged.

The CPI(M) alleged that the Union government with its decision to monetise its assets across key sectors has announced the "sale of India".

"The central government has officially announced the sale of India. The National Monetisation Pipeline released by the finance minister yesterday details the loot of our national assets and infrastructure. This is an outright plunder of people's wealth?" the CPI(M) said.

The Left party also alleged that this was like "selling family silver" to meet daily expenditure of the country which "makes neither economic nor common sense".

With PTI inputs