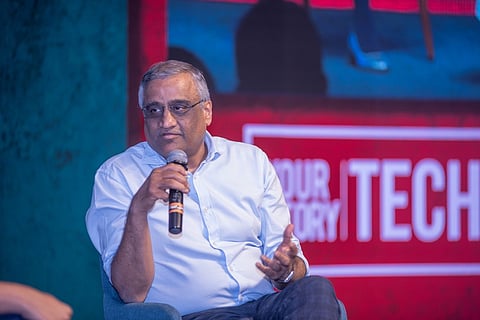

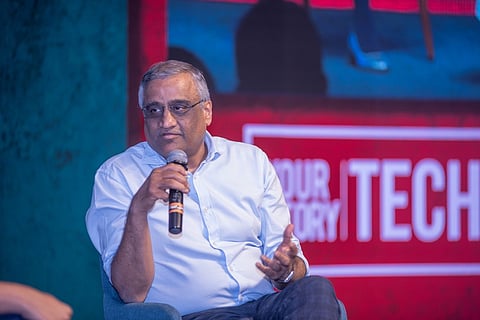

The Securities Appellate Tribunal (SAT) has stayed the Securities and Exchange Board of India’s (SEBI) order that had barred Future Group CEO Kishore Biyani from accessing the securities market for a year. The market regulator also gave relief to his brother Anil Biyani and Future Corporate Resources Pvt., along with other individuals who were accused of insider trading.

A company statement said the appellate tribunal has stayed the "effect and operation" of SEBI's order accusing the promoters of the Future Group of insider trading in the context of purchases of Future Retail shares made in March 2017.

However, the Future Group promoters have been been directed by the Tribunal to deposit Rs 11 crore as an “interim measure” and the case will come up for hearing on April 12, 2021.

As per the company, the restructuring of the home furnishing businesses in the Future Group -- with the physical store format of Future Retail and online store format of Future Enterprises being demerged into a new company -- had been well known in the public since 2016.

Future Group counsel Somasekhar Sundaresan argued that the actual terms of the restructuring were initiated only in April 2017 while the purchases were made in March to avail of the acquisition limits under the takeover regulations.

Earlier this month, the capital market regulator SEBI barred Biyani, among others, from the securities market for a period of one year for insider trading in the scrip of Future Retail (FRL).

The other entities and individuals barred by SEBI from the securities market were Future Corporate Resources Private Limited (FCRPL), Kishore Biyani's brother Anil Biyani, Rajesh Pathak and Rajkumar Pande.

An investigation had found that some of the entities traded in shares of Future Retail on the basis of unpublished price sensitive information (UPSI) violating SEBI norms during the period between March 10 and April 20, 2017, said the SEBI order.

Further, the notices were also restrained from buying, selling or dealing in the securities of Future Retail Limited (FRL), directly or indirectly, in any manner whatsoever, for a period of two years.

SEBI in its order had also asked Future Corporate Resources, Kishore Biyani and Anil Biyani to jointly and severally disgorge an amount of over Rs 17.78 crore along with an interest at the rate of 12% per annum from April 20, 2020 till the date of actual payment.