A day ahead of the Budget, the government released the Economic Survey where it has specified that it needs to look for new ways to find money without compromising the fiscal deficit targets.

"The coming year will pose several challenges on the fiscal front. Firstly, there are apprehensions of slowing of growth, which will have implications for revenue collections. Secondly, the financial year 2018-19 has ended with shortfall in GST collections," said the survey, tabled in Parliament on Thursday.

Be that as it may, startups have their own set of expectations from the Budget. Here’s a cross-section of startups and what they want:

Indroneel Dutt, CFO, Cleartrip

We are optimistic and hopeful that the government will continue to be open-minded and maintain the impetus of its past initiatives while bringing necessary reformations to further enable the aviation sector. The Regional connectivity Scheme titled UDAN needs particular attention and allocation in this Budget. Increased digital penetration in the last few years has been one of the biggest contributors to the rise of the Indian travel industry. So, we expect the budget to sustain and accelerate India’s digital journey. We also hope that the Government will bring necessary provisions to accommodate four different slabs under ‘One GST Rate’ in this budget. Simplifying input credit mechanism on air and accommodation services including big-ticket transactions like travel bookings, along with processes like GST filing, will provide a fillip to the sector.

Gautam Raj Anand, Founder and CEO, Hubhopper (India's largest podcasting and Assistance on Demand platform)

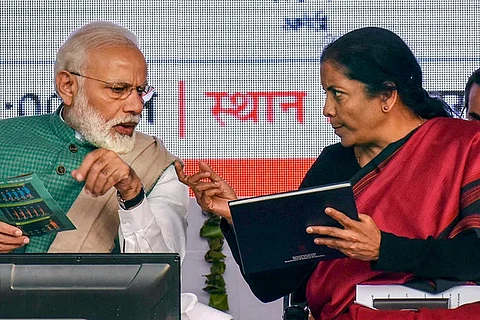

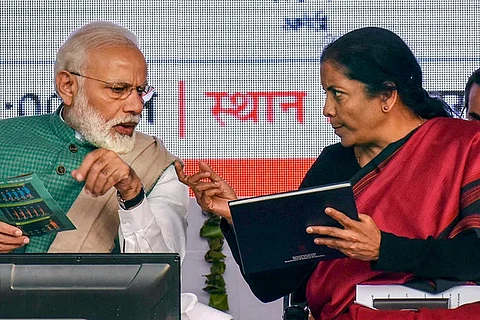

With podcasting industry gearing up for a transformational year with the convergence of media, technology and telecom industries coupled with the government’s vision to further accelerate the Digital India program, most experts also support that the Budget 2019 will only help to streamline this transition more positively. This industry is also expected to grow in conjunction with an increase in smartphone user base, provided Ms. Seetharaman continues with her pinpointed focus on digitisation.

The Budget is also set to help the innovators in this industry as the government looks towards scaling up digitisation across all industries that touch a common person’s life and concerns their needs.

Gauri Singhal, Founder and CEO, Visionaari (parent company FLOH Tampons)

This year’s budget is expected to boost the number of smartphone users and e-commerce firms. With more women in tier 3 and tier 4 towns opting for shopping online and high amount of rural spending, there lies a huge scope for FMCG and menstrual hygiene brands in small towns. Additionally, a few legislations on this phenomenon can help with providing access to products which are a necessity for women. Small towns like Patna, Jharkhand, Uttarakhand and Ambala are likely to witness the transformation of kirana shops into online stores.

Saru Tumuluri, CEO, Khosla Labs, provider of Veri5Digital, India’s leading identity verification platform

Innovation in fintech should be driven more aggressively by the regulators. The regulatory sandboxes initiative needs to go live as quickly as possible starting with all the financial regulators enabling all the fintech players to develop more products in an accelerated manner - this will be a big boost for the fintech landscape of India. A fintech innovation fund should be created to help boost startups in digital identity and fintech space.

Saurav Goyal, CFO, Money View

Beyond physical spaces and support systems, the policy ecosystem must be shaped to encourage risk-taking, innovation and growth. The Government as part of the budget should provide necessary clarity in terms of taxation norms and make a requisite change in the policies in accordance with the latest business practices, post factoring another regulatory requirement.

Vinamra Pandiya, Founder & CEO, Qtrove.com

I hope that the government will focus on the startups and continue to help them grow like they have in the last couple of years. Section 56 needs to be removed completely so that the startup ecosystem thrives in this country. The government had promised that angel tax would be exempted for companies who have just started, but we are still receiving notices on the tax to be paid on the funds that were raised. Waiver of such taxes will only help the startup culture and entrepreneurial culture in this country.

Devendra Rane, Founder & CTO - Coverfox.com

Government should include more categories in SEZ, where the country needs to promote entrepreneurship. Key areas being micro fintech products which increase penetration to the under-served India. Also, the Govt. should encourage usage of cutting edge technologies in AI and ML where China is taking huge steps forward. And it would be great if the government removes angel tax provisions and brings transparency into the process of angel funding. Also, regulatory sandbox should allow more number of startups to try innovative and non-conventional products by easing the eligibility criteria.

Neetish Sarda, Founder of Smartworks

For the corporate sector, while there has been capital inflow from investors, the ease on External Commercial Borrowings (ECB) would help foreign investors gain more confidence in the market which would result in a sustained and steady inflow of capital from them. For co-working firms particularly like ours, we hope that the government will extend Input Tax Credit to the commercial segment, especially on work contracts and construction services which would help reduce our cash outflow. Likewise, keeping up a uniform corporate tax structure would be welcome. The government should also look at modifying or eliminating Angel Tax to enable more leasing of space to small and medium sized enterprises as well as improving infrastructure in Tier 2 cities which are emerging co-working hubs.

Rajesh Loomba, Managing Director of Eco Rent A Car (An official ground transportation and luxury car rental company)

Previous budgets and governments have always neglected tourism. I hope in this budget some focus is put into tourism as a generator of employment and not be treated as an elitist activity. High Taxation on tourism combined with road taxes for tourist entries which is additional in every state is a penny wise pound foolish approach. GST needs to be revised for various sectors especially the hospitality sector where it's currently very high especially for Self Drive Car Rental services.

Pradeep Dadha, Founder and CEO, Netmeds.com

The Modi government's flagship healthcare scheme, 'Ayushman Bharat' may get an upgrade with focus on the availability of affordable healthcare and a far more robust public healthcare policy. We believe that generic drug substitution will play a pivotal role in lowering the public healthcare cost drastically, making quality healthcare accessible to the remotest corners of the country. The government should support initiatives to fight the public perception of generic drugs and increase awareness among the masses. Industry bodies have also suggested that the government give a much-needed boost to the preventive healthcare ecosystem in the country.

At the policy level, the ruling government has already drafted e-pharma norms after due diligence. Once a legal framework is set, medicine delivery and other health-tech startups will be able to operate within a conducive environment. Quick implementation will, in turn, ease the bureaucratic process and facilitate fundraising activities for healthcare/ health-tech startups.