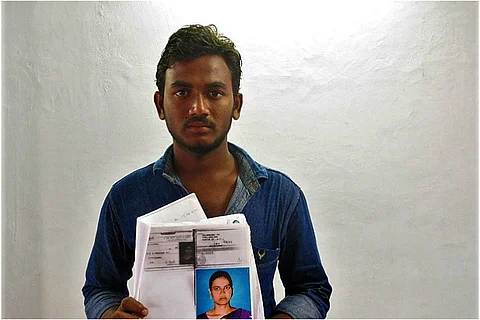

21-year-old Dugge Navin Kumar looks solemn, his weariness making him much older than his years. Clad in a blue shirt and jeans, Navin has come with hope in his heart on hearing that someone wants to know about his case.

Though his hopes fall when he learns that it is a reporter wanting to hear his story, he is determined that the world should know the tragedy that has befallen his family.

Navin’s mother Dugge Jyothi died in May 2015, one of the over 150 people whose lives have been claimed by the Agri Gold scam, in which lakhs of investors across nine states have been cheated out of thousands of crores.

"Amma was a hard worker. She wanted my brother and me to be highly educated. I am just a painter, but with my measly resources, I want to get justice for my Amma," says Navin.

(Right: Navin)

Rise and fall of Agri Gold

Agri Gold was set up as a Collective Investment Scheme (CIS) company in Vijayawada in 1995, and grew exponentially over two decades. It amassed 16,000 acres of land in seven states with money taken from 32 lakh small and marginal investors, besides deposits of more than Rs 500 crore in multiple commercial banks.

For these lakhs of people, Chairman Avva Venkata Rama Rao and his company held out the promise of a bright future, by offering highly lucrative returns on meagre investments. Essentially, the company collected payments from all these men and women with the promise of doubling their investment or providing residential land of the equivalent value within six years. To make the scheme even more lucrative, Agri Gold gave its marginal investors the freedom to pay the money in flexible instalments.

Like many others, Dugge Jyothi first came to Agri Gold as a customer in 2007. But within a year, Jyothi, who was the animator for a Self Help Group in her home village of Velagapudi (now the site the temporary Andhra secretariat), turned into an agent for Agri Gold. Beginning with her own neighbourhood, Jyothi began to recruit dozens of new customers for Agri Gold from various parts of Guntur and Prakasham district.

With the money that Jyothi and thousands of other agents like her helped raise (Rs 6,385 crore in total, with around Rs 3957 crore coming from Andhra Pradesh alone), Agri Gold aggressively expanded into a variety of sectors including real estate, housing and construction, power projects, dairy farming, luxury resorts and so on.

But by 2014, the tide began to turn as customers were not receiving payouts or land, and cheques that had been issued began to bounce in many cases.

Suddenly, in Velagapudi, Jyothi was faced by crowds of 70-80 customers, who threatened her with dire consequences if they did not receive their money back soon. Though Jyothi trekked often up to the Agri Gold head office in Vijayawada office in search of answers, the picture began to grow bleaker, says Navin.

"She visited the head office several times seeking reimbursement of her people’s money, but she never got any response. Day by day she suffered more and more thinking about the massive losses that had occurred to people, and one day she passed away right in our home," says Navin.

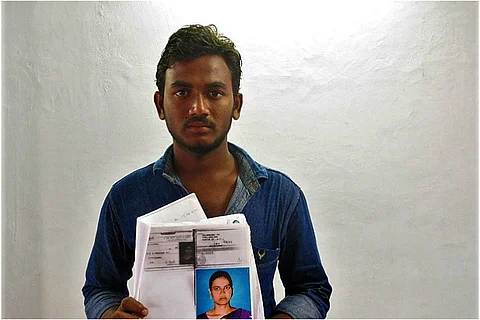

(Navin holds up a photo of Jyothi along with her documents)

Before she died, explains Navin, Jyothi even sold off all her land to pay off Rs 14 lakh to angry customers. While the current value of the land she sold off amounts to nearly Rs 50-60 lakh, all Navin has to show for it is the ID numbers of Jyothi’s customers. Even the original documents of their deposits aren’t with them as Jyothi submitted them to the Agri Gold office shortly before her death.

So even as investigating authorities hold out hope to cheated customers by asking them to verify the documentation of their deposits at district data collection centres, Navin worries that this will be of no use for his family.

"How do we get our money back? All that we can provide is the customer payment ID number," he says anxiously.

Selling empty dreams

The first signs of trouble with Agri Gold emerged in November 2014, when many angry customers landed up at the company’s offices to complain about bounced cheques and unpaid interest. By January 2015, that number had grown to thousands and a series of complaints of fraud, cheating and other irregularities were registered against the company’s Chairman and Directors and other officials of the company.

It then emerged that the company’s entire investment scheme had been illegal, as it was being run without the requisite permissions from the Reserve Bank of India (RBI) and the Securities and Exchanges Board of India (SEBI).

M Nageshwar Rao, CPI leader and Honorary President of the Agri Gold Customers and Agents Welfare Association, says that the company had built up its entire operation on nothing but empty promises and the persuasion of its agents in the countryside. And it was all possible because government authorities failed to check Agri Gold’s activities for years.

“From 1995 till this (police complaints against Agri Gold) happened, all the rulers praised them,” alleges Nageshwar Rao.

(Nageshwar Rao (Centre) addresses mediapersons)

Though the case was taken up by the CID, and the government attached Agri Gold’s assets to auction them off to recover depositor’s funds, progress on all fronts of the case has been slow. It was only in February 2016 that the CID arrested A Venkata Rama Rao and Managing Director A Venkata Seshu Narayana Rao.

And it is only recently, with the Essel Group coming forward with the offer to take over Agri Gold’s assets, and with the government beginning verification of the deposit details of thousands of customers, that some slivers of hope have begun to be seen on the horizon for aggrieved customers.

Too little too late for many

But for the families of the over 150 victims who have already lost their lives following the scam, any corrective action seems to have come too late.

Take the case of 18-year-old Thota Shravani, whose parents dreamed fondly of educating her as an engineer. Shravani had to drop out of her Engineering degree and spend a year at home, and is now training to be a primary school teacher, after her father Thota Srinivasa Rao died of a heart attack in July 2016.

Srinivasa Rao had been a travelling salesman, hawking clothing from the back of a motorcycle in the Chilakaluripeta area for 20 years, before being drawn into the Agri Gold trap. Everything went downhill for Srinivasa Rao when the more than 50 customers who had sunk Rs 20 lakh into Agri Gold through him, turned on him after their returns began failing.

“Everywhere he went, there were people asking him for their money back,” says Anuradha, Srinivasa Rao’s wife. “We sold off all my gold and emptied all our savings to pay back people Rs 5 lakh.”

(Shravani and Anuradha)

As the losses mounted, Srinivasa Rao lost hope and grew more and more depressed, until his heart finally gave out.

“We wanted to make Shravani into an engineer, but after his death, we lost everything,” says Anuradha.

Even Srinivasa Rao’s death has not spared his family of continued harassment from customers for their hard-earned money. "Even after my father's death, many customers keep asking us about the case and the money, even though they know what is happening to us," says Shravani.

Agents facing people’s ire

As the government’s intervention into the case proceeds at a slow, halting pace, customers cheated out of their hard-earned money have a more immediate target – the agents who convinced them to invest in the first place.

Like Muvva Sambaiah, a tenant farmer holding two acres of land in Mutluru in Vatticherukuru Mandal. Having recruited around 30 customers, who deposited a total of nearly Rs 8 lakh in Agri Gold, Sambaiah wisely cautioned them from putting further money into the company when things took a turn for the worse in 2014.

But the demands for the money that had already been put in soon mounted. “As the pressure from customers grew too much, he stopped even stepping out of house. On February 25, he died of a massive heart attack because of tension and depression," says his wife Koteshwaramma, who now lives with the family of her son Venkata Krishna Rao.

The family is still constantly plagued by customers, who all want their savings returned immediately, says Venkata Krishna Rao. "We don't have the money or property for our own survival and everybody knows this. But even then we are being treated as thieves by the customers. Even recently one woman came asking us for the money. What can we tell her?"

Despite the harassment, says Koteshwaramma, she can’t find it in herself to blame the customers since they are only worried for the money that they worked long and hard to save up painstakingly. "It is their hard-earned money and, like anyone else, they will definitely have fears of losing their money," she says.

Their backs to the wall, their breadwinners gone, these families are still in shock over the sudden turn in their fortunes in a matter of just a couple of years.

"Neither he nor we thought something like this could happen. We believed in the company since they were paying us well every month. But now our lives have ended up on the streets," says Koteshwaramma.

The only hope they now cling to is that the government will somehow solve their problems and give them and their customers back their precious savings. “The government will help us, won’t they?” they ask endlessly, grasping at meagre hope of somehow salvaging their lives again.