M2P Fintech, Asia's largest API (Application Programming Interface) infrastructure company, on Tuesday, October 12 announced that it has secured $35 million in Series C financing. Tiger Global Management led the round with existing investors BEENEXT, Flourish Ventures, Omidyar Network India, 8i Ventures, Better Capital, and the DMI Group via its investment vehicle Sparkle Fund participating in the round.

Chennai-based M2P intends to use the fresh funds to enhance its API infrastructure capabilities and expand its reach beyond Asia. According to the company, M2P’s platform powers some of the leading banks, fintech, and consumer internet companies across Asia becoming the leading fintech enabler in the region.

M2P says it has achieved 400% Y-o-Y revenue growth and is processing more than $10 billion in annualised payments volume across millions of users through 500+ fintech partnerships. M2P has a market presence in India, Nepal, the United Arab Emirates, Australia, New Zealand, the Philippines, Bahrain, and Egypt. The company plans to expand its footprint to Indonesia, Bangladesh, Vietnam, and across the MENA (the Middle East & North Africa) region.

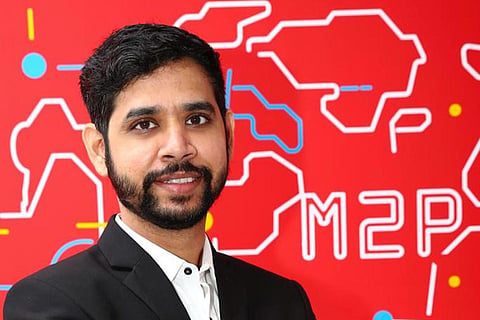

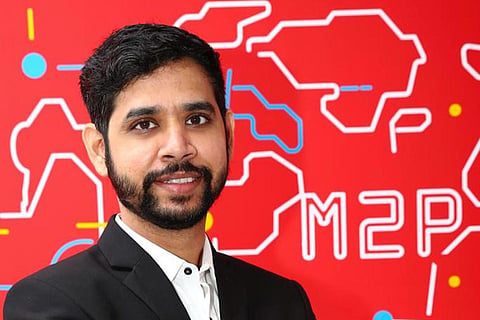

Madhusudanan R, Co-founder and CEO of M2P Fintech, said: "The founding vision of M2P Fintech is to enable every company to become a fintech. Our immediate focus is to double down on growth in India and the expansion of our team in Dubai, where we have committed to invest more than AED 100 million over the next 18-24 months. We are also aggressively pursuing organic and strategic opportunities that will strengthen our product capabilities to better serve our customers.”

"We are delighted to have the backing of Tiger Global Management, with its track record of investing in category-leading companies. Having built an API ecosystem for unlocking the latent fintech potential in emerging markets, we believe the time is ripe for us to export the capabilities from India to other parts of the world,” he added.