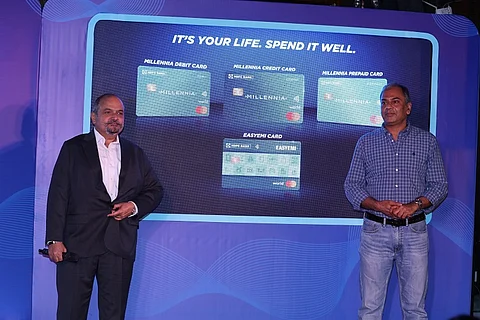

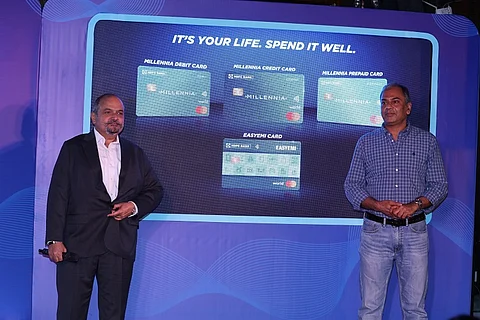

HDFC Bank and MasterCard have launched Millennia, a range of cards catering exclusively to the lifestyles and aspirations of millennials. With millennials accounting for 34% of India’s population, the cards come loaded with benefits and rewards specifically for the digital-first generation.

HDFC says that research showed them that millennials in India are shaped by technology and are not in a hurry to achieve traditional milestones. They are equally focused on leisure and value new experiences. Entertainment including dining out, travel, apparel, and lifestyle purchases are high on their list of priorities.

“We are extremely excited about the journey that we are embarking upon. Millennials are the future of our country and present a huge opportunity to us. I am very confident that this unique range of cards will not only complement their distinctive lifestyle, but also allow us to meet their evolving needs,” said Mr. Parag Rao, Country Head, Card Payment Products, Merchant Acquiring Services and Marketing, HDFC Bank.

The Millennia range of cards comes in four variants to cater to different types of users.

The Millennia Credit Card: Offers 5% cashback on all shopping via SmartBuy and PayZapp, 2.5% cashback on all Online spends, 1% cashback on in store spends and Wallet re-loads, eight complimentary lounge access in a calendar year and fuel surcharge waiver of 1%

Millennia Easy EMI Card: This offers automatic EMI conversion of spends above Rs. 10,000 for 9 months, 5% cashback on all shopping via SmartBuy, 2.5% cashback on all Online purchases, 1% cashback on all in-store spends and wallet re-loads, and fuel surcharge waiver of 1%

Millennia Debit Card: This gives users upto Rs 4800 cashback per year, 5% cashback on all shopping via SmartBuy and PayZapp, 2.5% cashback on all online purchases, 1% cashback on all in-store spends and wallet re-loads, 4 complimentary Domestic Lounge access annually and an insurance cover of up to Rs. 1.10 crore.

Millennia Prepaid Card: Users get cashback upto Rs 5000 per year, this card can be used to withdraw cash from any ATM in India. There is also the 5% cashback on all shopping via SmartBuy and PayZapp, 2.5% cashback on all Online purchases and 1% CashBack on all other offline spends and wallet reloads.

“India is a young country, and the aspirations of millennials are evolving continuously. This generation of mobile-first digital natives provides a tremendous opportunity to drive a less-cash economy. Mastercard combines the best of safety standards with a seamless user experience and is increasingly transforming into a lifestyle and experience-focused brand, which millennials value. Mastercard is delighted to partner with HDFC Bank for the launch of an exclusive range of cards targeting this segment,” said Mr. Porush Singh, Division President, South Asia, Mastercard.