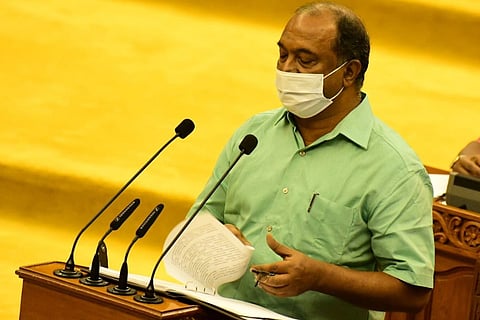

Kerala Finance Minister K N Balagopal on Saturday pitched for extending the GST compensation beyond June next year as he highlighted that the state is already grappling with significant revenue shortfall. Addressing the media in New Delhi, the minister said the state is not getting its due in the wake of the 15th Finance Commission devolution recommendations.

Kerala will be receiving GST (Goods and Services Tax) compensation of over Rs 13,000 crore and another one-time grant of over Rs 19,000 crore in the current fiscal ending March 2022, he noted. In case the GST compensation ends next year, then the state will face further revenue shortfall, he said and expressed hope that the compensation regime would be extended.

The regime of paying compensation to states for revenue shortfall resulting from subsuming their taxes such as VAT in the uniform national tax GST will end in June next year. However, the cess which is currently levied on top of the GST rate on certain luxury and sin goods to fund the compensation amount for states will continue to be levied till March 2026. The collections will be used to pay off the borrowings that had to be done since 2020-21 to pay for state compensation.

Meanwhile, the Union government may not need to open special borrowing window to meet GST compensation needs of states in the current financial year as rising indirect tax collections on economic recovery have given confidence that the government may meet its tax liability through estimated buffers in its finances. The Union government has estimated GST compensation shortfall to states at Rs 1.59 lakh crore for FY22. Out of this, Rs 75,000 crore has already been released as first instalment through regular central borrowings. The government had opened a special borrowing window last year to meet the estimated shortfall of Rs 1.1 lakh crore in revenue arising on account of implementation of GST.